International trade by its very nature, is subject to constant peaks and valleys. As a global player with a vast network all over the world, Brecon faces the responsibility of factoring in local realities everyday. It requires both reactive and proactive action from our sales and logistics teams. But the benefit of conducting intercontinental business is that with so many tariffs, legislation, and agreements at play, sales environments are ripe with opportunity; a single door closing might mean that three new windows are simultaneously opening.

That’s the value of working with Brecon. Our residuum of MAP certified supply chain partners allows us to be better prepared for volatile market fluctuations and unforeseen crop conditions. It puts us in a position where we can have a strong plan B. Honoring our commitments is important to us, that’s why we work hard to find alternative solutions when necessary. In order to do so, it’s critical for our team to remain updated on current market trends and forecasts.

“Meat” the Major Winners of the US-Japan Deal

In 2016, 12 countries bordering the Pacific Ocean (Malaysia, Vietnam, Singapore, Brunei, New Zealand, Canada, Mexico, Chile, Peru and the U.S.A) signed the Trans-Pacific Partnership trade deal with goals to lower tariffs and bolster trade and economic growth. In 2018, the U.S decided it no longer wished to participate in this partnership and pulled out.

Recently, Japanese and American government have found middle ground on trade negotiations and market access with a bilateral trade agreement that will play greatly in the favor of American beef and pork exporters.

Japanese tariffs on beef will see reductions of roughly 29% by 2033, from 38.5% to 9%. Pork tariffs will be eliminated on muscle cuts by the ninth year of the agreement while seasoned pork tariffs will be phased out by year five.

This combined with the announcement on November 14, that China has lifted the ban on U.S chicken/turkey suggests more favorable East-West market conditions for meat and poultry.

CETA’s Duty Free Berries

Closer to home, the Comprehensive Economic and Trade Agreement between the European Union and Canada has the potential to benefit businesses in both regions. The free trade model allows 94% of agricultural tariff lines to be duty-free, and is particularly “fruitful” for blueberries, cranberries, raspberries and blackberries.

Given that Canadian berry exports to Europe accounted for $102.1 M in 2016, and that Canada was the largest exporter of frozen blueberries and prepared cranberries that same year, CETA offers a sizeable advantage for Canadian exporters.

In cases like this summer, where Europe saw unfortunate crop shortages in certain berry sectors, CETA provided a mutual solution for both Canadian suppliers and European customers.

European exports to Canada are equally as noteworthy. As of August 30, 2019, Spanish horticultural exports to Canada showed a growth of 19% in just the first half of 2019. EU exports to Canada during this matched time period reached 62, 575 tons, representing an 18% increase in export growth from the year before.

Brexit State of Affairs

Frozen food sales in the U.K have increased as the fear of a “No Deal” Brexit has British shoppers stockpiling frozen fruits and vegetables for fear of limited access to fresh produce in 2020.

But beyond survivalist mad rushes to the grocery store, what does it all mean for the frozen food industry, or any food trade coming out of the U.K?

If the Withdrawal Agreement is not approved–meaning if the U.K House of Commons votes to reject the terms negotiated by the U.K Prime Minister and the leaders of the 27 EU countries– then this will result in a “No Deal” Brexit situation. A “No Deal” would subject all imports into the U.K to a 22% tariff, as determined by the World Trade Organization.

A “No Deal” scenario would essentially render the U.K to a “third country” status, stripping the country of access to existing international treaties made by the EU, as well as any previously held preferential trade rates.

For Canada, a No-Deal Brexit would result in two dynamics worth noting:

1) EU-Canada trade relations: would continue under the Comprehensive Economic Trade Agreement (CETA).

2) UK-Canada trade relations: would revert to the trading rules as outlined by the World Trade Organization’s Most Favored Nation structure and neither country could benefit from CETA. The U.K has released a proposed tariff schedule eliminating import duties on nearly 95% of goods; under the WTO’s Most Favored Nation rules, this would apply to Canadian businesses for one year. Canada and the U.K would then negotiate a separate bilateral agreement, should the “No Deal” come into force. The Canadian Trade Commissioner’s office has advised Canadian businesses that they fully intend to deepen trade relations with the U.K.

Conversely, if the Withdrawal Agreement is voted in by the British House of Commons, Canada and the U.K will enter a transition phase, where existing trade relations will remain the same, so long as Canada chooses to give the U.K consent to continue to participate in CEFA.

Other Important Trade Considerations:

EU/U.S Airbus Tariff: As of October 17, 2019, the U.S government backed by the World Trade Association has imposed a 25% tariff on certain import goods sourced from the European Union. In the food and beverage sector, this includes dairy products, certain types of fruits, olive oil, juices and essential oils.

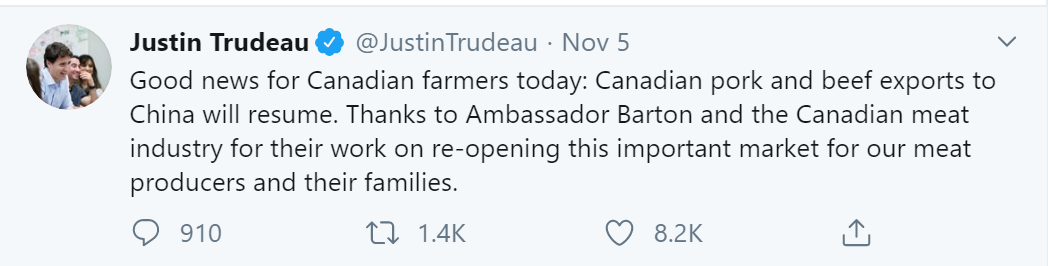

Canadian Re-admittance to Chinese Pork Game: On November 5th, 2019, Prime Minister Justin Trudeau tweeted that the ban on Canadian pork into China has been lifted.