As our global supply chain continues to face unprecedented challenges; Brecon is relentlessly working alongside our International network of preferred Service Providers to mitigate the negative impacts of the market’s volatility on our customers.

Globally, Russia is the third largest oil producer with roughly 50% of production sold to the European market. Europe’s sudden shift away from Russian origin oil to alternate producing nations has propelled an astronomical rise in energy costs.

With Diesel prices in EU representing approximately 1/3 of trucking operating costs combined with driver shortages and recent strikes, European freight rates are at record levels, and show no signs of abating in the short term.

Russia and Ukraine are also respectively the largest and 5th largest wheat exporters in the world. After several poor harvests and frantic pandemic buying Wheat prices which were already 49% above pre pandemic levels have risen by another 30% since the invasion of Ukraine.

Russian Sanctions, although necessary, have added further pressure to the Global Supply Chain. Chinese origin produce once railed through Russia must now be shipped to already over congested European ports. Critical Fertilizer Components exported from Russia will now also be severely affected by the introduced sanctions. This will directly impact farmer’s margins globally and result in a much greater share of income spent on food.

In North America, the trucking industry is being severely impacted with fuel surcharge prices rising to unparalleled levels to cover the soaring diesel prices reaching more than $5/gallon.

Drayage costs at all major US and Canadian ports is 32% higher than 2021. These costs will continue to climb until the cost of diesel fuel and demand returns to pre pandemic levels.

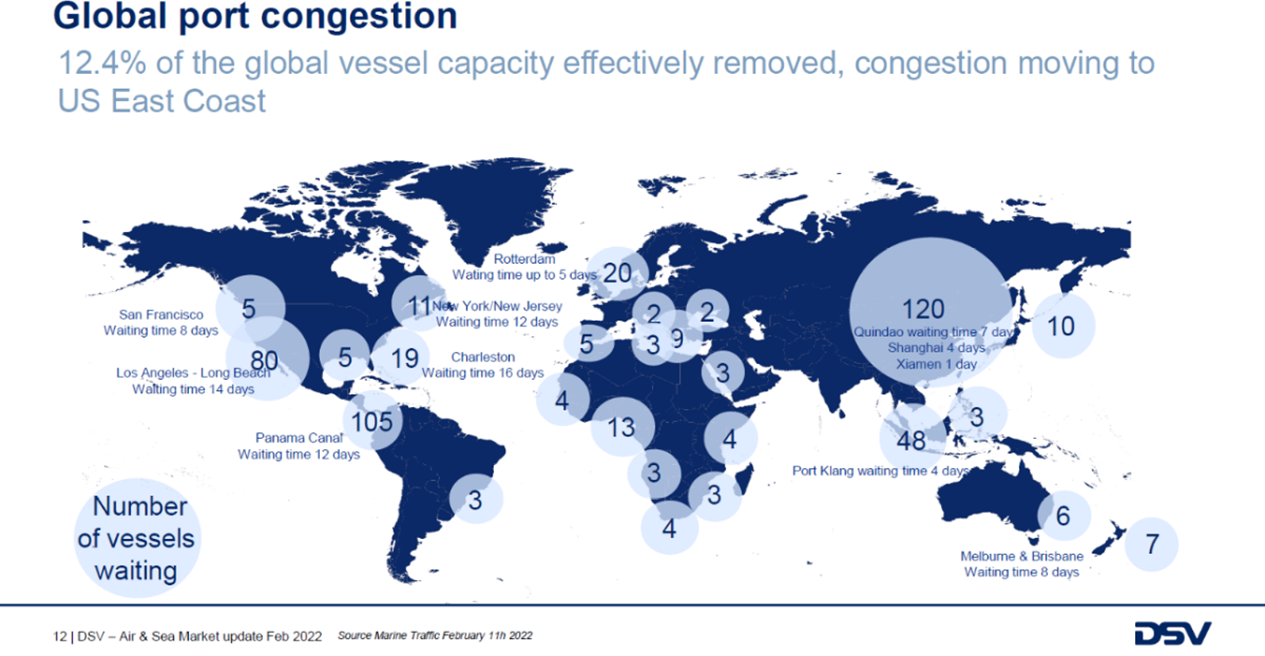

The schedule reliability reported at 30.9 percent by sea intelligence for January 2022 is the lowest ever global schedule reliability since the measure started in 2011 and it does not appear that improvements are on the horizon until 2023.

Congestion is set to continue to worsen on the West Coast and the number of ships waiting offshore of East and Gulf Coast ports are hitting new highs.

Deutsche Bank predicts Hapag Lloyd and Maersk’s average freight rates will be up 30% this year versus 2021. It forecasts that Maersk’s 2022 EBITDA will be $34.6 billion, up 43% from 2021, and that Hapag-Lloyd’s 2022 EBITDA will be $20.4 billion, up 56% from last year.

Experts believe there is no indication that any improvements are on the horizon for 2022 in terms of reliability or a decrease in freight rates. The supply chain inefficiencies that existed in 2021 are still present and the changes to the industry structure may be permanent according to Ben Nolan shipping analyst at Stifel.

Numerous calls from various export associations for greater regulation have largely remained unanswered and it is too early to tell whether regulators will impose changes to the industry structure and what practices will be targeted by the governments potential policies.

Brecon remains committed to supporting your business throughout these uncertain times. Our Logistics Team is dedicated to servicing your supply chain from origin to delivery. We are working closely with Service Providers around the globe to stay informed and provide optimal solutions. Brecon continues to prioritize investment in innovative technology solutions. Our investment is driven to better track container movements and provide greater insight into industry and individual Service Provider performance.

Brecon understands the importance of getting your product to destination both on time and in optimal condition. Freight continues to be unreliable and subject to change based on equipment availability and vessel schedules. All freight will be advised at time of booking and finalized at the time of shipment. We will continue to provide regular market updates and keep you informed on industry developments.