Red Sea Disruptions Continue to Reshape Global Shipping

The geopolitical crisis in the Red Sea continues to ripple through the global shipping network. Most major carriers are now avoiding the Suez Canal entirely, opting instead for the much longer Cape of Good Hope route. This shift has extended transit times significantly, put pressure on equipment availability, and created urgency across cold chain operations. For exporters of perishable and frozen goods, the margin for error has narrowed — and the need for reliability has never been higher.

Reefer Rates Remain Elevated

Refrigerated container rates are still on the rise, driven by tightened capacity and strong seasonal demand. The South American and African export peaks are putting exceptional strain on the system, and equipment remains in short supply across key ports. Latin America, in particular, is experiencing some of the most acute shortages, with longer round trips further compounding the challenge. As logistics partners, we’ve had to respond with faster decisions, more aggressive planning, and deeper visibility across our networks.

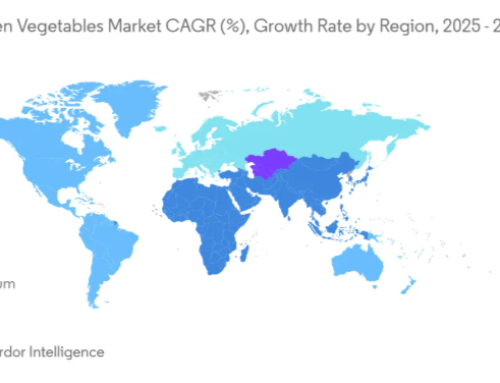

Frozen Food Sector Sees Major Growth

Despite logistical headwinds, the frozen food industry is entering a high-growth phase. The global market is expected to grow substantially over the next decade, fueled by both consumer demand and innovation in freezing and packaging technologies. Canada is emerging as a central player in this expansion — one of the world’s fastest-growing exporters of fresh and frozen produce, backed by greenhouse innovation and clean, efficient infrastructure. That’s good news for the North American supply chain, and even better for those positioned to capitalize on it.

Trade Policy Volatility Demands Strategic Flexibility

While the 90-day U.S.–China tariff pause offered temporary relief, the broader landscape remains unstable. Tariffs on both sides continue to reshape trade routes and influence sourcing strategies. Freight rates, especially on the China–USA corridor, remain high due to a wave of front-loaded shipments, while Southeast Asia and India grow in importance. The underlying message is clear: businesses can’t afford to operate on autopilot.

New Environmental & Compliance Pressures

Maritime shipping is entering a new regulatory era. Environmental measures, such as the EU’s carbon trading rules and IMO’s decarbonization targets, are changing the financial equation for carriers. Carbon surcharges, compliance costs, and emissions reporting are now part of the everyday logistics dialogue. At the same time, new rules on ballast water, vessel recycling, and cybersecurity are tightening the operating environment across key jurisdictions. These changes aren’t temporary — they are structural, and the companies that plan for them will be the ones that thrive.

Brecon’s Response: Proactive, Informed, and Resilient

Brecon Foods approaches every disruption as an opportunity to lead with clarity. We don’t wait for problems to escalate — we act early, align with the right partners, and design solutions with resilience in mind. Our customers depend on us not just to move product, but to see what’s coming next and make sure they’re ready for it. In a market defined by complexity, that mindset makes all the difference.

#BreconFoods #SupplyChain #FrozenFoods #LogisticsUpdate #ReeferShipping #MaritimeLogistics #FoodExport #Q22025